The ZMDK Chronicles

Dive into a realm of news and insights with 0396zmdfk.

Why Paying More for Insurance is Like Choosing a Salad at a Fast Food Joint

Discover why splurging on insurance is just like picking a sad salad at fast food—both might leave you feeling unsatisfied!

Why Paying More for Insurance is Like Choosing a Salad at a Fast Food Joint: Understanding Value vs. Cost

When it comes to insurance, many people find themselves wrestling with the concept of value vs. cost. Similar to selecting a salad at a fast food joint, your choice often hinges on immediate gratification versus long-term benefits. A cheap insurance plan might seem appealing at first, much like a low-cost, calorie-laden salad that promises health but delivers little in nutrients. In the end, just like those fast food salads that can be loaded with unhealthy toppings, a less expensive insurance policy may offer inadequate coverage, leading to larger expenses down the road. Investing in quality insurance ensures that when unforeseen circumstances arise, you’re not left scrambling to cover the difference.

Understanding this dichotomy helps consumers make more informed decisions. Imagine you’ve made a choice at that fast-food restaurant: you’ve opted for the salad, only to realize it’s filled with hidden calories. This is akin to selecting an insurance plan that appears affordable yet comes with numerous exclusions and deductibles. While the initial costs are lower, the true value of insurance lies in using it effectively when you need it most. Always remember, sometimes, paying a little more now for comprehensive coverage can save you from significant hardship later—just as a quality salad may keep you healthier, happier, and ultimately, less stressed in the long run.

Is Your Insurance Plan the Salad of Your Choices? A Comparison of Costs and Benefits

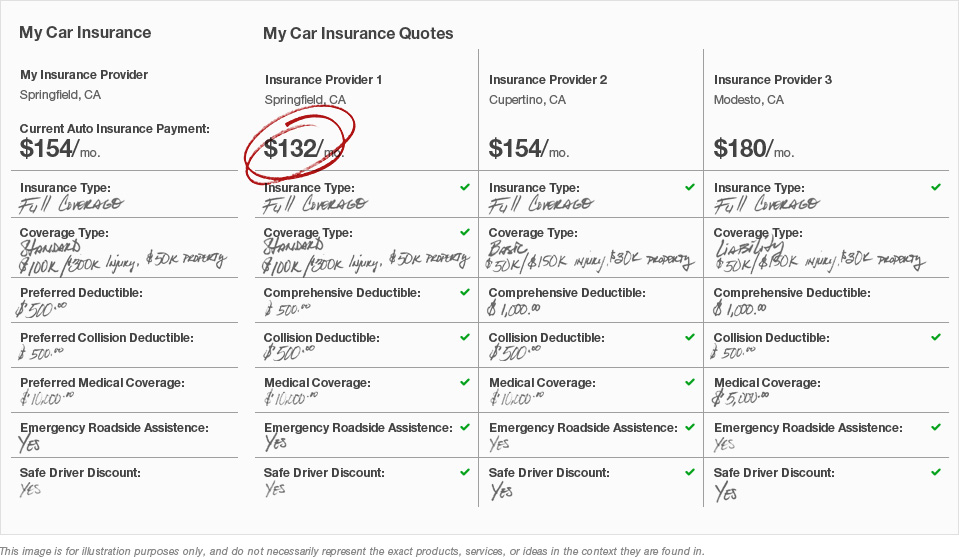

When it comes to selecting an insurance plan, many people find themselves navigating a menu of options that can feel as overwhelming as choosing a salad at a buffet. Each plan offers a unique mix of benefits and costs, akin to the varied ingredients in a salad, making it essential to understand what you're truly getting for your investment. Just as a salad can be loaded with nutrient-rich vegetables or weighed down by heavy dressings, your insurance plan can either provide comprehensive coverage or leave you exposed to significant financial risks. To make the best choice, consider conducting a thorough comparison of the benefits each plan offers, emphasizing policy details like deductibles, coverage limits, and provider networks.

However, don't let the allure of a seemingly low-cost option mislead you into making a hurried decision. Just as some salads may appear healthy but are actually high in empty calories, an insurance plan that promises affordability may come with hidden costs or insufficient coverage. It is crucial to weigh the benefit of an affordable premium against potential out-of-pocket expenses in the event of a claim. To make an informed choice, use a comparison chart to lay out the key features, and ask yourself: Is this plan truly the best fit for my needs, or am I just choosing the most appealing option on the menu?

What Can Fast Food Salads Teach Us About the True Cost of Insurance Premiums?

Fast food salads often present themselves as a healthier alternative to traditional fast food options, yet they can be deceptively high in calories and hidden costs. Similarly, insurance premiums can appear manageable at first glance but may conceal underlying factors that significantly impact your overall financial commitment. Just as a fast food salad can contain high-calorie dressings and toppings that inflate its health value, insurance policies can have clauses and add-ons that increase premiums beyond the base rate. Understanding these intricacies is crucial in making informed decisions about both fast food choices and insurance premiums.

Moreover, the price of a fast food salad often reflects not only the ingredients but also the branding and convenience of the meal. In the same way, insurance premiums can be influenced by a company's reputation, customer service, and the perceived value of coverage. For instance, opting for a well-known provider may yield higher premiums due to trust and reliability, much like how choosing a premium salad option might come at a higher cost due to its ingredients and preparation. Ultimately, both fast food salads and insurance premiums serve as reminders that the apparent simplicity of a choice often belies a complex web of costs that merits careful examination.