The ZMDK Chronicles

Dive into a realm of news and insights with 0396zmdfk.

Dancing with Dollars: Exploring the Rhythm of Marketplace Liquidity Models

Unlock the secrets of marketplace liquidity! Dive into Dancing with Dollars and discover how money flows shape your trading success.

Understanding Marketplace Liquidity: Key Models and Their Impact

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing a significant impact on their prices. Understanding the key models that influence liquidity is crucial for both investors and businesses. Two main types of liquidity models exist: the order book model and the quote-driven model. In the order book model, buyers and sellers place orders, which creates a visible list of buy and sell prices. This transparency allows for quick transactions and often leads to higher liquidity. On the other hand, the quote-driven model relies on market makers who provide buy and sell quotes, ensuring there is always a market for an asset, which can be especially reliable in less liquid markets.

The impact of liquidity on marketplace dynamics cannot be overstated. High liquidity typically results in narrower bid-ask spreads, lower price volatility, and more efficient price discovery, making markets more attractive to traders and investors alike. Conversely, low liquidity can lead to larger price swings and increased trading costs, which might deter participation. As such, understanding liquidity models and their implications can empower participants in navigating the complexities of marketplaces, enabling better decision-making and enhanced investment strategies.

Counter-Strike is a popular tactical first-person shooter game that has captivated gamers since its initial release in 1999. Players are typically divided into two teams, terrorists and counter-terrorists, engaging in various objectives such as planting bombs or rescuing hostages. For those looking to enhance their gameplay experience, using a daddyskins promo code can provide access to exclusive skins and gear that improve both aesthetics and performance.

The Dance of Supply and Demand: How Liquidity Shapes Your Marketplace

The concept of supply and demand is fundamental to understanding how markets operate, shaping everything from pricing to availability of goods and services. At its core, the dance of supply and demand illustrates the dynamic interplay between sellers and buyers. When demand exceeds supply, prices tend to rise, encouraging producers to increase their output. Conversely, when supply surpasses demand, prices often fall, leading to potential market saturation. This volatility is further influenced by liquidity, or how quickly an asset can be bought or sold without affecting its price. In a highly liquid market, transactions happen swiftly and efficiently, enhancing the overall stability of prices.

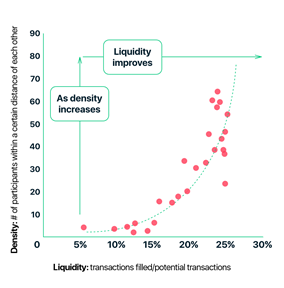

Liquidity plays a crucial role in how effectively supply and demand can meet in a marketplace. In a liquid marketplace, sellers can find buyers with ease, and changes in supply and demand can be absorbed without significant price fluctuations. This is vital for businesses and consumers alike, as it fosters confidence in transactions and encourages participation in the market. Additionally, understanding the cues of liquidity can help businesses strategize better by anticipating market shifts. Companies that adapt quickly to these changes will not only survive but thrive in a competitive landscape, reinforcing the importance of being attuned to the dance of supply and demand.

Is Your Marketplace in Tune? Assessing and Improving Liquidity Models

In the dynamic world of trading and e-commerce, liquidity models play a crucial role in determining how effectively a marketplace can match buyers and sellers. Assessing the current state of your marketplace's liquidity involves evaluating how quickly and efficiently transactions are executed. Key performance indicators such as transaction volume, order book depth, and the average time to complete a sale should be analyzed to gauge liquidity. Additionally, using tools such as liquidity analytics can provide insight into market behaviors, helping to identify bottlenecks or areas for improvement.

Improving your marketplace's liquidity may involve several strategies. First, consider implementing a dynamic pricing model that adjusts based on supply and demand, thus attracting more participants to the marketplace. Second, enhancing the user experience by simplifying the buying and selling processes can lead to increased engagement and faster transactions. Lastly, fostering a vibrant community through effective communication and feedback mechanisms will encourage user retention and drive more liquidity. By continuously monitoring and adjusting your liquidity models, you can ensure your marketplace remains in tune with the needs of its users.