The ZMDK Chronicles

Dive into a realm of news and insights with 0396zmdfk.

Marketplace Liquidity Models: Navigating the Ocean of Supply and Demand

Dive into the world of marketplace liquidity! Discover strategies to master supply and demand dynamics for success in your business.

Understanding the Basics of Marketplace Liquidity: Key Models Explained

Marketplace liquidity is a crucial concept in economics and finance, referring to the ease with which assets can be bought or sold in a marketplace without causing a significant impact on their price. Understanding the basics of marketplace liquidity is essential for investors, traders, and businesses alike, as it directly influences transaction costs and market efficiency. Generally, liquidity can be classified into two key models: order-driven markets and quote-driven markets. In order-driven markets, buyer and seller orders create liquidity as they are matched through a marketplace mechanism, such as an exchange. Conversely, quote-driven markets rely on intermediaries, like brokers or dealers, who provide liquidity by quoting buy and sell prices.

Each model comes with its own set of advantages and disadvantages. For example, order-driven markets tend to have high transparency and lower capital requirements, making them accessible for individual traders. However, they might experience higher volatility due to varying order sizes and timing. On the other hand, quote-driven markets offer the advantage of immediate execution, as liquidity providers can fulfill orders quickly, but may also introduce higher spreads and costs for the end user. Understanding these models and their implications can significantly enhance one’s investment strategy and decision-making process.

Counter-Strike is a popular multiplayer first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based modes. Gamers engage in intense battles, relying on teamwork and strategy to secure victories. Players often seek the best in-game items and skins, and using a daddyskins promo code can enhance their experience by providing discounts or bonuses on these items.

How Supply and Demand Shape Marketplace Liquidity: A Deep Dive

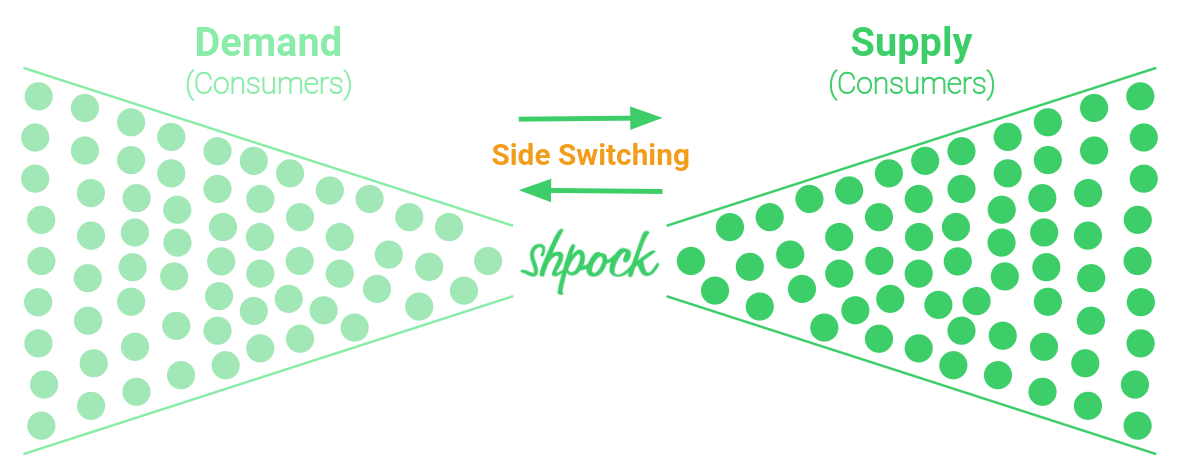

The dynamics of supply and demand are fundamental to understanding how marketplace liquidity operates. In essence, liquidity refers to the ease with which assets can be bought or sold in a marketplace without impacting the asset's price. A high level of liquidity typically indicates a strong market where there is an abundance of buyers and sellers, making transactions seamless. Conversely, when demand outstrips supply, liquidity can shrink, leading to increased volatility and wider bid-ask spreads. Factors that influence market liquidity include economic conditions, investor sentiment, and external market events, which can all shift the balance between supply and demand rapidly.

To illustrate this relationship, consider the following scenario: when a new product launches and generates significant consumer interest, the demand often exceeds the initial supply. This gap can trigger a rise in prices due to increased competition among buyers, which may deter some potential customers from making a purchase. On the other hand, if suppliers increase production in response to demand, they can stabilize prices and enhance market liquidity by ensuring that more buyers can successfully make transactions. Therefore, a thorough understanding of how supply and demand interplay is crucial for both investors and businesses looking to navigate a competitive marketplace effectively.

What Factors Influence Marketplace Liquidity and How Can You Navigate Them?

Marketplace liquidity is influenced by several key factors that can affect the ease with which assets are bought and sold. One of the primary factors is trading volume, as higher volumes typically indicate greater market interest and reduce the spread between buying and selling prices. Additionally, market depth plays a crucial role; ample buy and sell orders at various price levels ensure that transactions can occur smoothly without significant price fluctuations. Other important elements include market structure, which refers to how buyers and sellers interact and the presence of market makers who facilitate trades, and external economic factors, such as changes in regulations or market sentiment that can impact liquidity.

To effectively navigate these factors and enhance your experience in trading, it is essential to utilize market analysis tools that allow you to track liquidity trends and gauge market conditions. Engaging with reliable platforms that provide real-time data and insights can help you make informed decisions. Moreover, building a diverse portfolio across different assets can buffer against negative impacts of low liquidity in specific markets. Finally, staying updated on market news and adjustments in economic policies can further enhance your ability to anticipate changes in liquidity, allowing for strategic positioning and timely trades.