The ZMDK Chronicles

Dive into a realm of news and insights with 0396zmdfk.

Trade Like a Rebel: CS2 Reversal Strategies Worth Noticing

Unlock powerful reversal strategies in CS2 and learn to trade like a rebel! Discover the secrets that can elevate your trading game today!

Mastering CS2 Reversal Strategies: Key Techniques for Savvy Traders

In the fast-paced world of trading, mastering CS2 reversal strategies is essential for any savvy trader looking to optimize their gains. Understanding the fundamentals of market reversals can significantly increase your profitability. Key techniques such as trend analysis, support and resistance levels, and pinpointing market sentiment are critical components of effective reversal trading. By combining these elements, traders can develop a robust strategy that anticipates market shifts before they happen.

One of the most effective ways to enhance your approach to CS2 reversal strategies is by employing various technical indicators. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracement levels can provide valuable insights into potential reversals. Additionally, maintaining a trading journal can help you track your performance, refine your strategies, and stay focused on your goals. By implementing these key techniques, you'll be well on your way to mastering the art of reversal trading and achieving long-term success.

Counter-Strike is a popular tactical first-person shooter game that has captured the hearts of millions of players worldwide. Its intense gameplay and strategic elements make it a staple in competitive gaming. For those interested in improving their in-game economy, checking out the trade reversal guide can provide valuable insights on how to optimize trades and manage equipment better.

Are You Making These Common CS2 Trading Mistakes? Learn How to Reverse Them

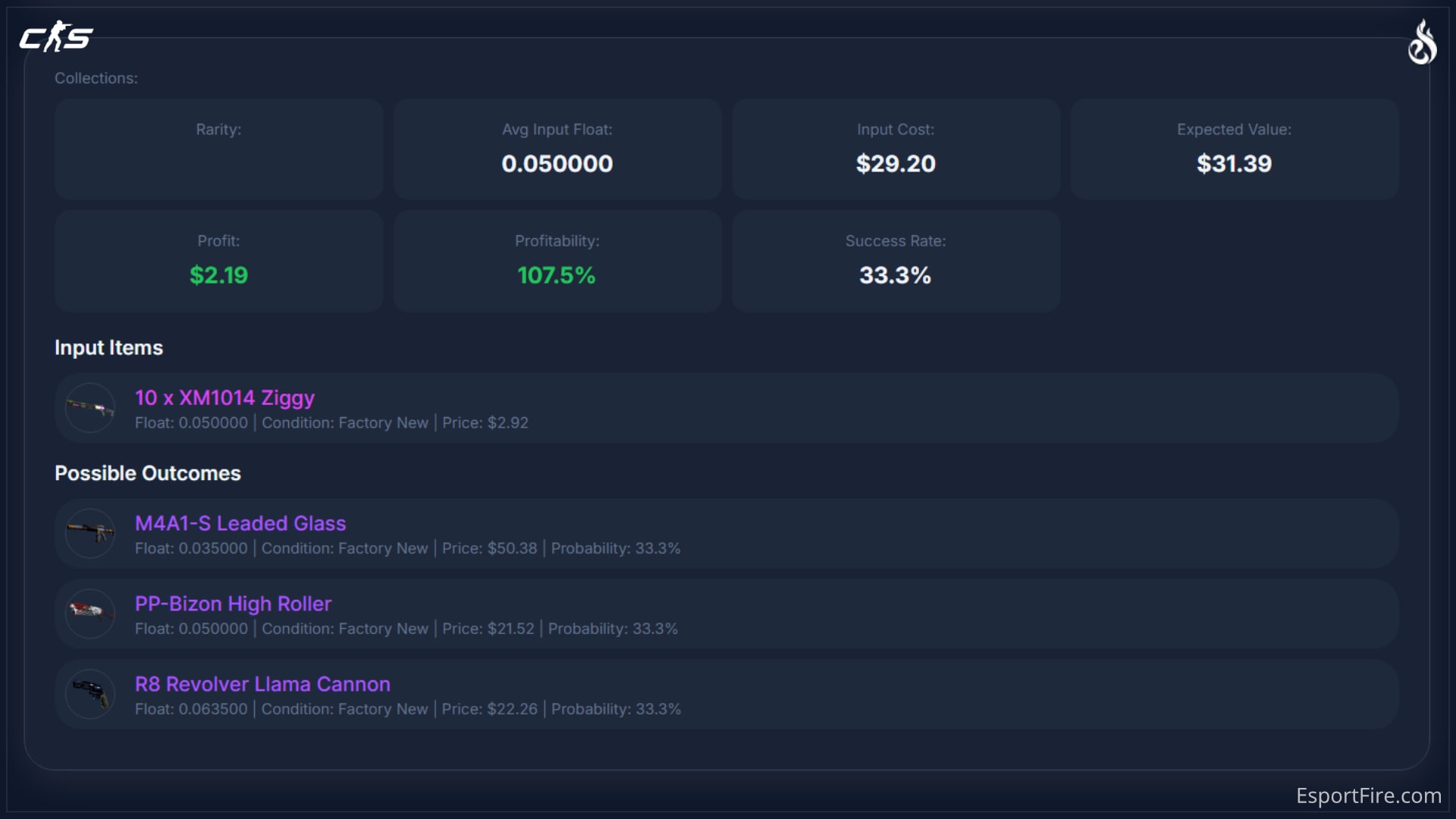

When it comes to CS2 trading, many players unknowingly fall into the trap of common mistakes that can cost them valuable items and in-game currency. One prevalent error is underestimating the value of items. Players often sell their skins or items at a fraction of their worth simply because they lack market knowledge. To avoid this pitfall, take the time to educate yourself on the market trends, item rarity, and current demand. Websites and forums dedicated to CS2 trading can provide invaluable insights and tools that empower you to make informed decisions.

Another mistake to watch out for is trading impulsively. The excitement of acquiring new skins can lead to hasty decisions that result in unfavorable trades. To counter this tendency, consider implementing a trading strategy that involves research and patience. Before finalizing any trade, evaluate your options and compare potential offers meticulously. By developing a well-thought-out trading plan, you can significantly enhance your trading experience and increase the chances of building a valuable inventory in CS2.

Unlocking Potential: Effective Reversal Strategies Every Trader Should Know

Unlocking potential in trading often requires a clear understanding of effective reversal strategies. These strategies are essential for traders looking to capitalize on market fluctuations and minimize their losses when trends shift unexpectedly. One popular approach is the use of candlestick patterns, which can signal potential reversals based on the behavior of price action. For example, patterns like the hammer or shooting star can indicate a shift in market sentiment, providing traders with the opportunity to enter or exit positions effectively.

Another effective strategy involves the use of technical indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). These indicators help traders identify overbought or oversold conditions, hinting at possible reversals. By integrating these techniques into a comprehensive trading plan, traders can enhance their decision-making process and better manage their risk exposure. Ultimately, understanding and implementing these reversal strategies is crucial for anyone looking to unlock their full potential in the trading world.